The Biggest Financial Scams and Ponzi Schemes in History

Financial scams have been around for a very long time. They can range from misusing donations and writing bad checks to multi-million dollar pump-and-dump schemes and other forms of corporate greed. The Ponzi scheme is a particularly popular scam that got its start in the 1920s (more on that later).

Although the scale and scope of the scams may change, the overall result is the same: most people lose a lot of money and a few people get fantastically rich – at least for a while. Over time, however, the unbelievable returns on investment seem too good to be true, and the authorities investigate. The perps are caught, fined, and jailed. Let’s take a look at some of the most famous financial scams.

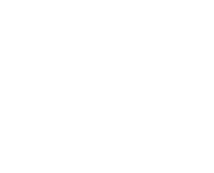

Charles Ponzi

If you’ve ever heard of “Ponzi” schemes, then you can thank the following man for that. In the early 20th century, Charles Ponzi made nearly $15 million in a little over a year and a half.

US Government // Wikimedia Commons

He did it by promising new investors returns of 50 – 100%. Instead of actually growing a business by that much, Ponzi simply used the money from new investors to pay old investors. When there weren’t enough new investors, the scheme collapsed and he was thrown in jail.

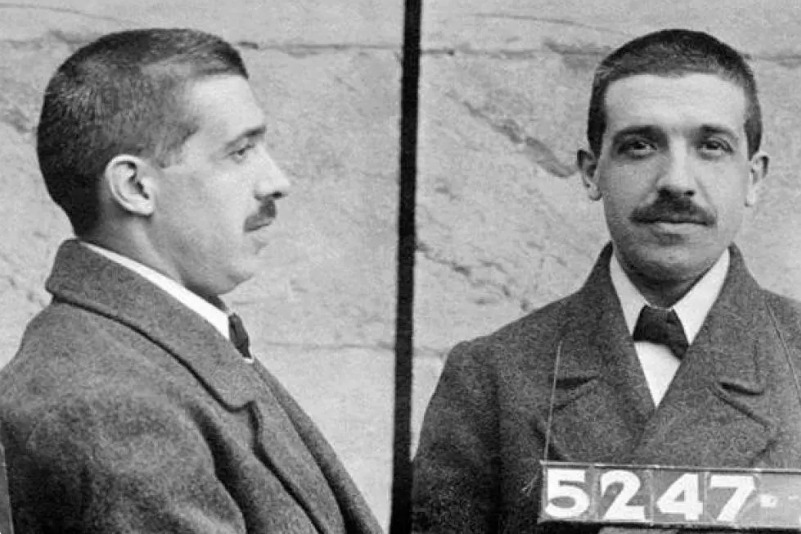

Bernie Madoff Nearly Perfected the Ponzi Scheme

Charles Ponzi might have invented the Ponzi scheme, but Bernie Madoff brought it to new heights. Rather than running it for 18 months, Madoff’s scheme lasted for nearly 18 years! Finally, in 2009, it came crashing down shortly after he revealed to his sons it was “one big lie.”

TIMOTHY A. CLARY / AFP // Getty Images

The total cost of that one big lie was nearly $19 billion. His Ponzi scheme involved those he didn’t know along with his close family and friends. He was sentenced to 150 years in prison and died in 2021.

Belle Gibson's Wellness Scam

Belle Gibson was a wellness blogger who took to social media to trick and target young girls and sick children. She pretended to have brain cancer then tricked the world by selling products, a cookbook, and a wellness app detailing how she cured her brain cancer with modern lifestyle and dietary changes.

Washington Post/ @hrealing_Belle Instagram

Belle promised her social followers she’d donate the majority of the proceeds from her products to charity and research but instead spend $91,000 of the money generated for personal use and vacations. After finally getting caught, she admitted her story and cancer diagnosis was false and ended up getting fined $410,000 on top of $100,000 penalty and interest charges.

FBI Investigates Abscam

The FBI wanted to investigate government corruption in the late 1970s and early 1980s, so they launched a controversial program called Abscam (loosely meaning “Arab scam”). FBI officials enlisted the help of Melvin Weinberg, a prominent con man who became an informant, to look at corruption in politics and business.

After two years, Abscam managed to catch on videotape seven politicians doing corrupt deals with fake Arab sheiks. They served a few years in prison. In 2013, the Hollywood film American Hustle told the story of the scam.

Frank Abagnale Jr. Gets Caught Impersonating Pilots

If you’ve ever seen the 2002 film Catch Me If You Can, then you’re familiar with Frank Abagnale Jr. The movie – based on Abagnale’s autobiography – dramatized the exploits of this infamous con man. During the 60s and 70s, he did a variety of scams.

These ranged from impersonating pilots, doctors, and lawyers to writing bad checks worth millions of dollars. He was finally captured in France in 1969, did time, and then used his talents to help the FBI find people like him.

Jim Bakker and the Televangelism Scam

In 1976, televangelist Jim Bakker and his outgoing wife Tammy Faye debuted The PTL Club, also known as The Jim and Tammy Show. It was a late-night Christian show that, at its height, raked in nearly $1 million a week!

Peter K. Levy // Flickr

Turns out that was too good to be true. In 1989, the financial scam was up. Bakker was charged with mail fraud, wire fraud, and conspiracy. His 45-year sentence was reduced to 8 years, of which he served 5 years in total. Upon release, he went back to televangelism.

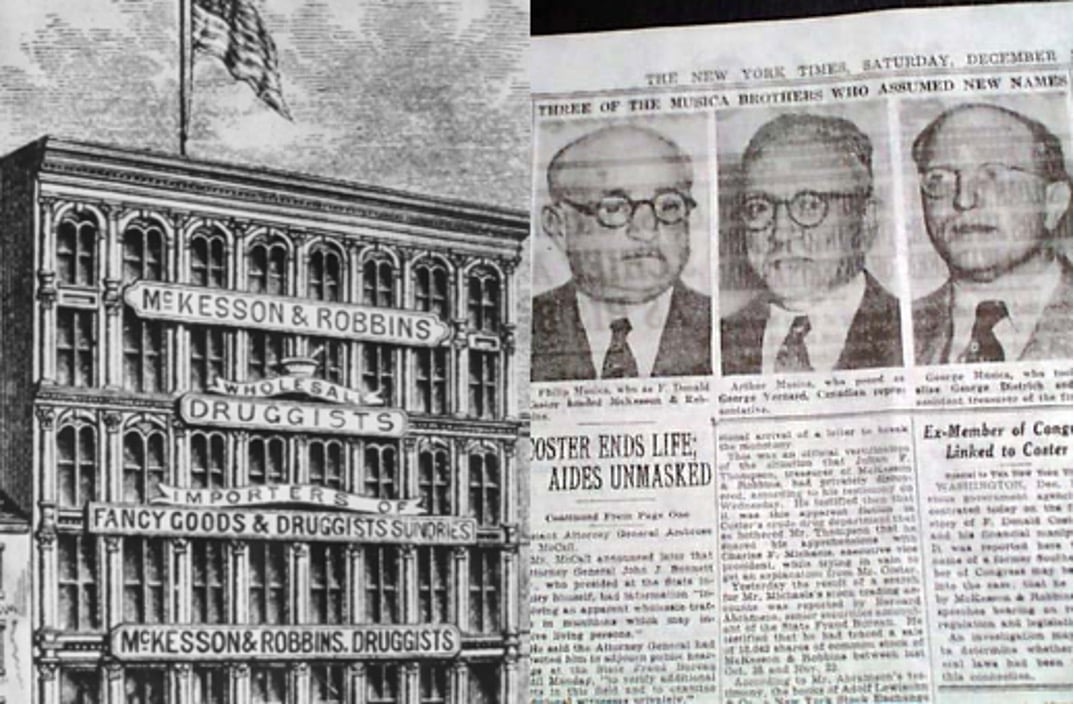

McKesson & Robbins Scandal

In 1925, Philip Musica (under the name F. Donald Coster) bought the pharmaceutical company, McKesson and Robbins. It was during the height of prohibition, so Musica (a seasoned criminal) used it as a way to provide a legitimate cover for his bootlegging business.

He enlisted his brothers (under fake names) to create fake companies that wrote fake documentation that made the business look legit. In 1938, after earning millions of dollars, the SEC found out and they were arrested. Musica committed suicide rather than going to jail.

Charles Keating's Worthless Bonds

Wall Street in the 1980s was a place where regulations were loose because political contributions were big. There was little incentive to really look into the activities of financial wizards like Charles Keating.

AP

Keating was head of Lincoln Savings and Loan Association. In 1989, the company failed because it was full of worthless bonds that left 23,000 people with nothing and cost the government nearly $3 billion. For all that, he was sentenced to less than 5 years in jail. Upon release, he became a realtor.

Jordan Belfort, The Wolf of Wall Street

The 2013 film The Wolf of Wall Street was based on a 2008 memoir by Jordan Belfort, a former stockbroker who manipulated the market to make millions. He did this by creating Stratton Oakmont in 1989 and using it to do pump-and-dump schemes – buying worthless stock, inflating the price, and selling it off at once.

Red Granite Pictures

This funded a lavish lifestyle of sex, drugs, and massive fraud that came crashing down in 1999. He stole over $100 million and received a 22-month jail sentence. Now he sells crypto.

Reed Slatkin and Scientology

Reed Slatkin was an investor and Scientology minister who co-founded the ISP company EarthLink. He also ran one of the largest Ponzi schemes in US history before Madoff, well, made off with that dubious title.

Esquire

From 1986 until 2001, Slatkin tapped into his Scientology, Hollywood, and tech contacts to get 800 wealthy investors to pour nearly $600 million into his scheme. His fraud and laundering charges resulted in 14 years in jail. In 2013, he was released, and, shortly thereafter, he died.

Enron Loses $74 Billion

Enron was an energy company from Texas that had nearly 29,000 employees right before it fell apart. It fell apart because it wasn’t actually profitable. Company CEO Jeffrey Skilling, chairman Kenneth Lay, and others basically took advantage of low regulation to create a web of accounting lies.

Houston Chronicle

That web included inflated profits and concealed debts that made the company look a lot better than it actually was. In 2001, it all crashed down as the stock price plummeted and shareholders lost near $74 billion.